The Internet of Things is transforming the way we live our lives. From appliances that talk to each other, to connected cars that promise to revolutionize the way we get around, there’s almost no aspect of life that won’t be touched by the IoT.

The growth of the IoT is stunning. At the end of 2017 there were about 500 million IoT devices with cellular connections. By 2023, that number is expected to grow to 1.8 billion. In total, Ericsson research predicts that by 2023 there will be 20 billion IoT connections across the globe, a growth rate of almost 20 percent per year from the 7 billion at the end of 2017.

This means that businesses will be just as profoundly affected by the IoT as consumers. This is especially true for telecom service providers who are connecting growing numbers of IoT devices, the fundamental building block of it all. Not only will they be focused on enhancing network infrastructure with IoT-friendly technology—like Cat-M1 and NB-IoT—on the road to 5G, they will be forced to consider how to transform their business as the IoT market matures.

To take advantage of the potential revenue streams the IoT will make possible, telecom service providers are already exploring moving from merely connecting devices to services like platforms and even applications.

It was with this in mind that Ericsson interviewed approximately 20 leading IoT telecom service providers worldwide, as part of our “Exploring IoT Strategies” study, to determine how the IoT is poised to change their business and how they are positioning themselves in the value chain to maximize market opportunities. They all recognized that they will have to adjust the way they operate, moving from traditional key performance indicators like revenue per subscriber to a completely different revenue model.

Based on this research, we gain a clearer picture of where telecom service providers fit in, how they move up the chain, and other aspects of how they can get the most out of the IoT market.

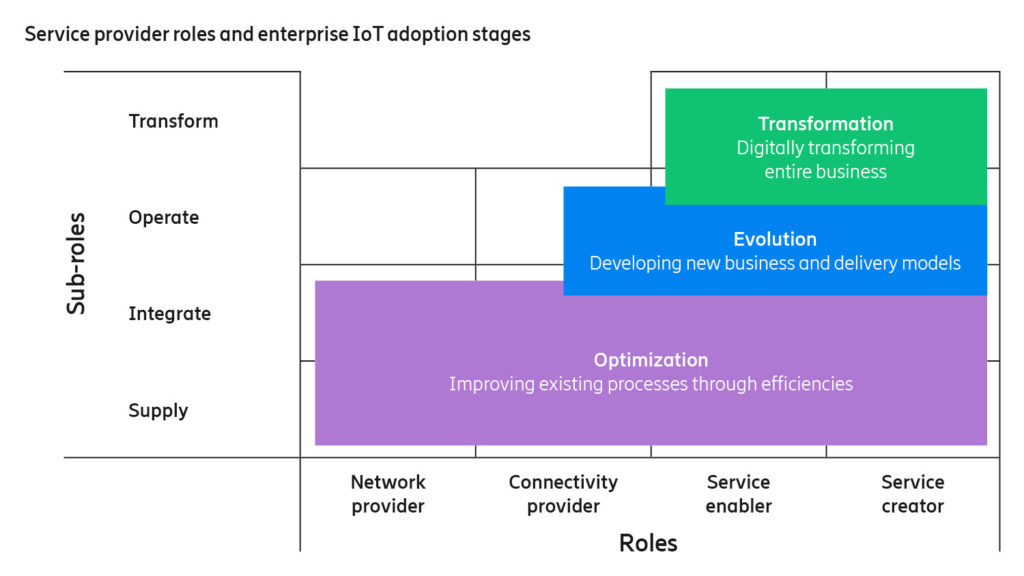

Ericsson’s Exploring IoT strategies report features roles and sub-roles that service providers adopt in different stages.

What is the IoT value chain?

The IoT value chain explains the building blocks of IoT, how value is created, who they players are, and how they interact with each other to deliver value.

Looking at the IoT value chain as a pyramid, at the base is all the connected devices: phones, fitness bands, connected cars, smart homes, and other devices on the consumer side; in industry, you have things like building sensors, smart cities, and connected factories, for example.

Stepping up a level from the base brings in the network and connectivity—how devices are connected and communicate. It’s also where service providers collect device and network data and upload it to the cloud.

Finally, at the top of the value chain, are applications and services that are closest to the eventual end users—enterprises and consumers.

What is the role of service providers?

As is the case with most quickly evolving technologies, today’s IoT market is a highly fragmented place. Telecom service providers are actively investigating various roles they can take along the value chain. And, while revenue growth has been unanimously confirmed as the chief driver for entering the IoT market, we have found multiple paths to revenues that service providers are pursuing.

Traditionally, of course, service providers have been focused on providing the network, and connectivity to that network. These services are naturally driving most of Ericsson’s research interviewees’ IoT revenues right now. It’s not surprising, then, that 60 percent of respondents are only dealing in the network and connectivity realm at the moment.

Our research shows, however, that service providers are looking to create value-added services that go beyond network and connectivity. In fact, fully 80 percent of respondents indicated that they have plans to move up the IoT value chain in coming years to become more involved in the delivery of platform and application services — after all, most telecom service providers have vertical industry solutions, even if they don’t specifically offer platform services.

Why move up the value chain?

The core strengths of most service providers today include tasks like rolling out networks, connecting and managing devices, and so on. In this nascent IoT market, most activities and revenue streams are still occurring at these device and network levels, which plays very well to service providers’ stronghold.

Ericsson has conducted a separate study on industry digitalization potential for telecom service providers and found that two-thirds of that potential—amounting to USD 416 billion globally in 2026—will come from more advanced services on top of network and connectivity provisioning.

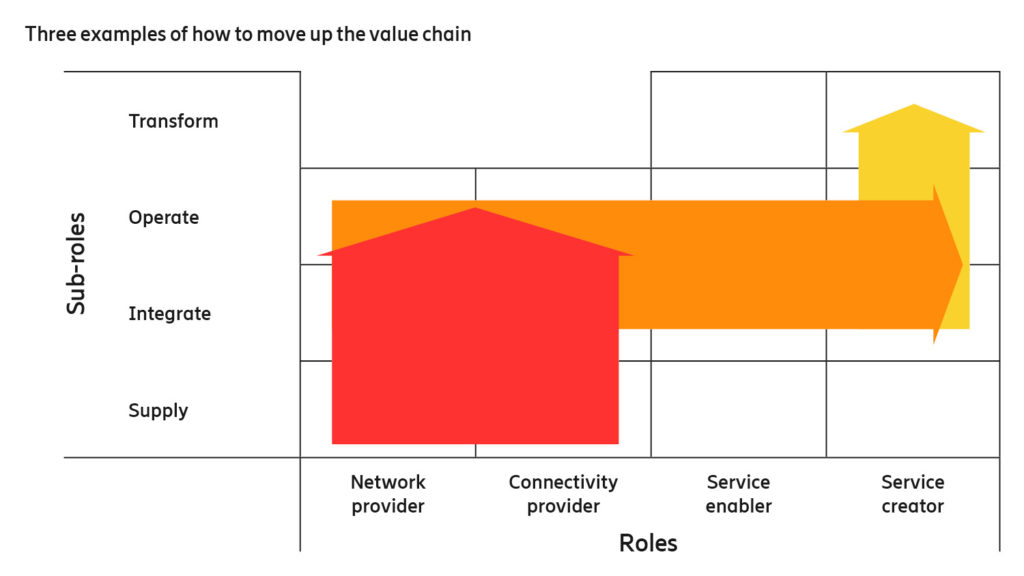

How can service providers move up in the chain?

For instance, telecom carriers may offer cellular and non-cellular IoT network integration services or device lifecycle management on behalf of enterprise customers. These diversifications lay a foundation for them to adopt more sophisticated roles in the future.

Of course, each of these roles and services has special requirements and skills needed. This means providers will have to expand out of their comfort zone if they want to move up the IoT value chain.

Look at the example of self-driving cars. When a critical mass of these vehicles are operating on the street, they’ll require extremely reliable and fast connections like 5G to communicate constantly. Service providers are in pole position to connect the vehicles. But, there is clearly the potential to provide more, like applications in those cars, or platforms for them to communicate.

This chart showcases three different ways to move up the value chain via Ericsson’s Exploring IoT strategies report.

What are the challenges of moving up the chain?

Moving up the IoT value chain is easier said than done. Service providers have mastered the art of operating in the network and connectivity level, it’s part of their bread-and-butter.

Getting to the platform and application levels, though, requires a deliberate and significant effort—it’s almost akin to transforming into a software company. The platform business, after all, is basically an IT endeavor, with software and applications delivered as a service. This is not only an entirely new area of technology for many service providers, it’s a new market with new service delivery methods.

Getting involved in vertical industry solutions and involving ecosystem partners, at the top of the IoT value chain, requires another step up. At this level, service providers will most likely need vertical industry expertise, systems integration capability, and an environment that fosters innovation for customers and partners, to name a few—that is completely different than the current network connectivity business most are used to.

How are service providers developing these new services?

Telecoms are also getting new capabilities through acquisitions. When a large company identifies skills or products it needs, it is often easier to go out and buy them, rather than to reinvent the wheel internally. This can happen very quickly, and acquiring—or even partnering—with smaller companies is becoming a good strategy for many of the operators we spoke with.

What is the future of the IoT value chain?

The IoT is on the short list of the most exciting technological advances in history. As it continues to develop, there’s almost no telling where it could go. One thing the market will likely move towards is more standardization. Think of the early days of railroads. When every company was using different track and axle dimensions it was difficult for the new technology to gain a foothold. Once the standard gauge was implemented, railroads almost immediately began disrupting the transportation industry on a much larger level.

Although good progress has been made in the past couple of years, the fragmentation and lack of broad standards continue to threaten IoT market growth. Greater standardization will be a good thing for everyone—from enterprises to consumers—and put the IoT on track for explosive growth.

Another thing is certain: competition will be fierce. As with any market, as the IoT becomes more mature, more businesses will be entering looking to get their piece of the pie. This is why moving up the IoT value chain is a compelling strategy for service providers. The key to success is to leverage off and build on the current strengths, before taking on new but complementary roles to bring new value. Always keep in mind that IoT is an ecosystem play so true success will call for industry-wide collaboration.

About the Author

About the Author

As Global Head of IoT Customer Engagement Marketing, Warren Chaisatien leads Ericsson’s engagements with telecom service providers on IoT business and technology strategies. Generating demand for the regional sales organizations, his C-level engagements focus on telecom service providers’ roles and opportunities in the IoT value chain. Warren brings 20 years of international ICT industry experience in marketing and strategy, as well as consulting and sales, spanning North America, Europe and Asia Pacific.